Japan's Next Great Entertainment Company

COVER Corporation (5253.JP) - Long - 24mo PT ¥4,950 - 95% Upside (40% IRR)

High-Level Points

COVER Corporation is the largest vertically integrated virtual YouTuber (VTuber) company in the world with 41% share of industry hours watched.

Investors underestimate the durability of revenue growth and EBIT margin trajectory due to the company’s unique business model and higher fixed-cost SG&A intensity relative to competitors.

I think revenue will compound at a 30% CAGR through FY28 and EBIT margins will expand 720bps from FY26 to FY28, resulting in a 43% EPS CAGR.

My price target is ¥4,950 in March 2027 (NTM P/E of 20x on my FY28 EPS of ¥248), a 95% return (40% IRR).

The main risks and concerns are an FY26 EBIT margin guide below consensus, talent graduations (retirements), engaged fan wallet pressure, and branch closures.

Despite these risks, the company has inherent upside optionality through meaningful video game revenue contribution, expansion in new geographies, and existing branch revenue parity.

Disclosure: I own shares in COVER Corporation (5253). This is not financial advice and is my own opinion on the company’s outlook. Do your own research and due diligence.

Company Overview

COVER operates as a talent management and content production company for its roster of 89 VTubers through its subsidiary, hololive production. A VTuber is a content creator that uses a digital avatar, in this case an anime character, instead of their own likeness when engaging with fans. Using motion tracking software, the avatar is rigged to mirror the talent’s real-time face and body movements. VTubers primarily livestream themselves playing video games, singing karaoke, and chatting with their viewers.

In essence, COVER develops VTuber IP1 in collaboration with external artists, gives talents those VTuber models to use while livestreaming and performing, and provides talents with the full suite of management, merchandising, and content production support. In exchange for giving talent organizational support, a VTuber model, and a larger audience, COVER takes the majority share of the revenue a talent generates.2

COVER generates revenue from four main areas categorized by the level of VTuber contribution:

Talent-direct: Revenue that requires whole involvement from VTuber talents. Lower margin due to higher profit sharing with talents.

Streaming / content: Revenue generated from livestreaming, videos on demand (VODs), and music royalties on streaming platforms. Livestreaming and VODs on YouTube are free to watch, meaning the company’s revenue generation model here is similar to that of a free-to-play game, where a small percentage of users generate the majority of revenue. The largest components of this line are YouTube channel memberships (viewers pay a monthly subscription fee for additional exclusive content) and Super Chats (viewers donate during livestreams with an attached message).3

Concerts / events: Revenue generated from online and in-person event tickets and products. The largest component is ticket sales for the company’s annual festival, holofes, held in Q4.

Talent-indirect: Revenue that does not require a VTuber to be present. Higher margin due to lower profit sharing.

Merchandising: Revenue generated from online and retail sales of merchandise related to VTuber IP. The largest component is made-to-order goods that are talent specific and pertain to annual events such as anniversaries or birthdays.

Licensing / collaborations: Revenue generated from VTuber IP licensing and promotional activities. For the most part, this revenue line is a black box, but typically only pertains to the company’s most popular VTubers (1M+ YouTube subscribers). This is the company’s highest incremental EBIT margin revenue line with peers at 50%+ EBIT margins.4

The company’s core audience is people in their 20-30s, mostly men, who are interested in video games, anime, and oshikatsu5. COVER’s largest market is Japan (~75% of revenue) but is rapidly growing its presence internationally (primarily North America).6 Currently, the company’s VTubers and corporate YouTube channels have a total of ~96M subscribers7 on YouTube (individual channel subscriber counts range from 82K to 4.6M) and 21M+ average monthly unique users8.

Investment Thesis Detail

1. COVER is the primary industry expander that is strategically positioned to capture and retain new and existing VTuber viewers with solid runway left in core audience adoption.

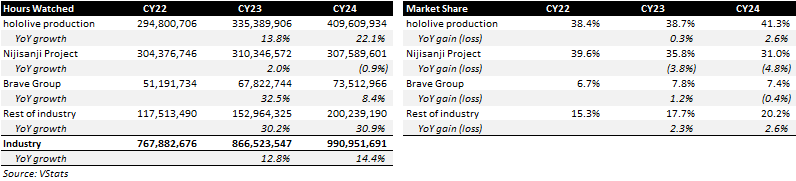

VTuber industry market share is heavily concentrated in the top three players: hololive production (41%), Nijisanji Project (31%), and Brave Group (7%), accounting for ~80% of hours watched. In CY24, hololive production accounted for ~60% of industry growth, driven by 7% YoY growth in average concurrent viewers (ACCV) and 11% YoY growth in the number of VTubers.

As the industry leader with growing viewership, COVER has built a virtuous cycle of expansion. As new viewers enter the market, hololive talents are usually the first VTubers they watch given their prominence.9 Given the scale of talent success, the company is increasingly likely to attract the most entertaining talents to join the company, of which they can select the talents that have unique skillsets and goals not already addressed by their current roster. This increases the likelihood that new viewers’ interests are satisfied, thus driving continued growth. It is important that the company reinvests to reinforce this advantage and bolster talent retention through greater creative resources and support.

Importantly, the company’s virtuous cycle works because of individual talent audience scale, strong talent support, and proper localization. This is most evident when comparing COVER to its largest competitor, Anycolor (Nijisanji). Strategically, Anycolor debuts new talents more frequently and provides them with less support, which has led to smaller individual audiences (cannibalization and dilution) and more frequent talent turnover. Additionally, Anycolor has generally failed to localize properly, resulting in the company exiting four of the six international markets they expanded into versus COVER exiting one.10

COVER’s talents on average have 2.3x the ACCV of Anycolor’s and 3x the support in terms of the content creation and agency team behind them.11

Though COVER’s core audience is niche, there is still significant room to grow before they exhaust their core and incremental new viewership needs to come from the long tail. Within the otaku12 population in Japan (the most developed VTuber market globally), VTubers have only penetrated ~15% of the anime fanbase and 25% of the popular idols fanbase, the closest comp.

Over the long term the increasing popularity of anime internationally provides a tailwind to VTuber adoption (ex-Japan anime industry revenue growth is accelerating, growing at an 11% 5Y CAGR).

2. Revenue is likely to grow at a 30% CAGR through FY28 as newer talents expand their reach and fans engage with new merchandising product lines.

Streaming / content revenue growth is the base for all other revenue growth. It captures the first and most frequent point of interaction between VTubers and their fans, meaning it is the best reflection of growth in viewers and changes in engagement. In 2022 and 2023, new VTuber debuts accounted for roughly half of streaming / content revenue growth. While it is necessary for COVER to continue to grow their roster of VTubers over time to increase the breadth and reach of the talents, too many debuts in quick succession can have a cannibalistic impact on viewership. Management has messaged that they are going to slow the pace of VTuber debuts in FY26 and focus on increasing viewership, meaning that revenue growth will largely be driven by average concurrent viewer growth (ACCV).13

Put simply, there are generally two ways to grow ACCV: encourage infrequent viewers to actively watch streams, and attract new fans. In general, I think it is easier to encourage active viewership as you are dealing with current fans of the talents. Historically, large talent collaboration events tend to have a positive impact on ACCV across the board. On the new viewer front, this can be driven by greater overall social media presence and paid advertising. Given COVER is the primary industry expander with dominant market share, new fan growth should be consistent with subscriber growth seen in more mature talents (5%+ CAGR).

I model streaming / content revenue growing at a 20% CAGR through FY28, mainly driven by ACCV growth in the company’s largest branch: hololive. When you disaggregate viewership data for CY24, the hololive branch accounted for 97% of hours watched while only accounting for 74% of talents. Additionally, the top four talents in hololive grew hours watched at a 23% CAGR with ACCV at 21,000+.

Assuming the company grows its VTuber count at a 7% CAGR, hours streamed per VTuber at 1%, and sees no expansion in revenue per hour watched, my streaming / content revenue estimates imply an ACCV growth CAGR of 11%.

In the near term hololive, hololive EN, and DEV_IS should be the primary drivers of ACCV growth. It is also likely that hololive ID and HOLOSTARS EN ACCV growth returns in CY25 as the CY24 declines were driven by lower hours streamed and debuts in the prior year, respectively. Streaming / content revenue growing at a 20% CAGR indicates even stronger merchandising revenue growth, especially as COVER expands their product lines.

Merchandising revenue has two main components: made-to-order goods and in-house planned goods.

Made-to-order merchandise typically grows slightly faster than streaming / content revenue and consists of talent-specific, customized merchandise geared towards heavily engaged fans.14

In-house planned goods consists of less-customized goods (plushies, acrylic standees, voice packs, etc.) and is geared towards less engaged or price sensitive fans. COVER is focused on expanding distribution and assortment in its in-house planned goods, most recently launching a trading card game (TCG) using its VTuber IP.

Since its launch in 2Q25, COVER’s TCG has continued to sell out with every new card set release. I estimate that TCG sales have been ¥1B+ per quarter with distribution focused mainly in the retail channel (70/30 split between retail/ecommerce). Management commented that they plan on releasing one set per quarter until they feel there is a great enough variety of cards before expanding the scale of product runs. Recently, COVER announced that they will be releasing the English version of the TCG in CY25 (likely in 2Q) which should contribute ¥3B+ to merchandising revenue.

Given these factors, I model merchandising revenue growing at a 36% CAGR through FY28 driven by in-house planned goods growing at a 45% CAGR (made-to-order goods growing at a 24% CAGR, slightly higher than streaming / content revenue growth).

For the other revenue lines, I model concerts / events revenue growing at a 16% CAGR (this is subject to revision given the quantity and scale of live events planned in a given year) and licensing / collaboration revenue growing at a 38% CAGR (I grow licensing / collaboration revenue per talent to reach the current LTM licensing / collaboration per popular talent of ¥132M) through FY28.15 These estimates result in total revenue reaching ¥98B in FY28 growing at a 30% CAGR (35% higher than consensus).

3. Investors should look through near-term EBIT margin stagnation and focus on the marginal profit ratio as COVER reinvests in reinforcing their virtuous cycle and establishing their presence overseas.

At the time of IPO (4Q23), management provided long-term guidance for 30% EBIT margins by the end of FY28.16 Since the IPO, COVER’s EBIT margin has expanded roughly 100bps over two years while revenue has more than doubled. This lackluster operating leverage is due to COVER reinvesting ~50% of marginal profit (revenue less variable costs, warehousing SG&A, and advertising expenses) growth in expanding the fixed cost base, primarily personnel (IP planning, sales and marketing, and back office).

It is becoming increasingly unlikely that COVER will achieve their 30% target by the end of FY28, as this would require the company to limit SG&A growth to a 2-10% CAGR with revenue growing at 20-30%. Management should push out their 30% EBIT margin guide, continue reinvesting in the near-term to reinforce their scale leadership, and point to marginal profit expansion as the KPI to watch.

Anycolor, which is COVER’s largest competitor, has a 37% LTM EBIT margin (~180bps higher than COVER) and is guiding to 40% in FY27. Though COVER is structurally more fixed-cost SG&A intensive than Anycolor due to metaverse spending, and greater talent support personnel, investors should have confidence that 30% EBIT margins are achievable by FY30 given the marginal profit structure and current revenue mix trajectory.

COVER currently has a 1,000bps lower marginal profit ratio than Anycolor, the difference explained by the company’s in-house warehousing operations and revenue mix (Anycolor’s mix is 20/80 talent-direct/talent-indirect).

I estimate that COVER’s revenue-line based marginal profit ratios are as follows: streaming / content at ~35%, concerts / events at ~20%, merchandising at ~45%, and licensing / collaborations at ~80%. For every 500bps of mix shift towards talent-indirect revenue, the overall marginal profit ratio should increase at least 175bps, which gives COVER a greater cushion to reinvest or grow fixed costs at a higher CAGR. Note that the merchandising marginal profit ratio should increase over time as COVER improves their warehouse logistics and higher margin products like the TCG expand.

With COVER’s revenue mix reaching 75% talent-indirect in FY30, driving 600bps of marginal profit ratio expansion to 49%, the company can grow fixed costs at a 13% CAGR (SG&A at a 10% CAGR) and still reach a 30% EBIT margin if revenue growth decelerates to a 20% CAGR. In addition to this, if COVER reinvested marginal profit growth into moving their HOLOSTARS branch closer to revenue parity with the overall talent mix I estimate EBIT margins would expand 500bps (the company would not need to make any additional fixed-cost SG&A investment so incremental marginal profit would flow through to EBIT).

COVER’s ability to reach a 30% EBIT margin is less so a question of possibility and more so a question of when the company wants to slow SG&A growth. I expect the bulk of EBIT margin expansion after FY26 as COVER will have built out their US office headcount, improved merchandising logistics from facility consolidation, and bolstered their leading industry position through incremental hiring. I model 720bps+ of EBIT margin expansion from FY26 to FY28, reaching ¥24B of EBIT (18% above consensus) at a 24% margin (340bps below consensus). The majority of operating leverage that I model comes from slower personnel expense growth post-FY26, driving 220bps of EBIT margin expansion. Over the long term, I expect COVER to increase their talent remuneration rates as a retention mechanism, which should have minimal impact on EBIT margin expansion.

Valuation

Given the lack of direct public comps (with the exception of Anycolor), I compare COVER to two baskets: IP-centric companies and idol companies.17

COVER trades roughly in-line with both comp sets despite revenue and EPS growth compounding at more than double the rate of peers. Over time, as COVER proves out its IP durability, reaches greater scale, and convinces investors of the margin story through execution, I think it could trade at a premium multiple (I do not incorporate any multiple expansion in my price target).

Management

Motoaki Tanigo is the President, CEO, and co-founder of COVER Corp. He has a background in video game development from working at Imagineer before becoming an entrepreneur. Tanigo founded COVER with current CTO Ikko Fukuda in 2016 and has no background as a public market CEO. Importantly, he is revered by VTuber fans for how he runs COVER and is very responsive to fan feedback. He holds a majority ownership of the company at 32% of shares outstanding (together, Tanigo and Fukuda own 36% of shares outstanding).

Upsides

New Branch Openings

New branch openings that address different languages would accelerate growth, especially in regions where other players have little to no presence.

Though fans with language barriers are still able to watch translated streams, VODs, and clips, the company could expand their success by having language-specific talents.

I think the most likely new branches would be Latin America or South Korea.

Video Game Revenue Contribution

The company is currently developing the equivalent of a branded version of Roblox, holoearth, for their audience to interact with their talents and create unique experiences.

This project has an immense amount of upside optionality in the case that it is successful but it does not make sense to include it in estimates at this point; in the case where it does not work COVER likely just writes off the software asset and gains 250bps+ of operating leverage from shutting down the metaverse team and removing the amortization expense.

I have the expenses and amortization from holoearth embedded in my ‘other SG&A’ estimates.

I am more positive on ‘holo indie’, COVER’s video game publishing subsidiary that allows third-party developers to use the company’s IP in video games.

Though most games created thus far have been moderately successful with hololive production fans, a game that reaches mainstream success reinforces the IP value of the talents and drives incremental growth in fans (HoloCure is currently the best example of this).

HOLOSTARS Revenue Parity

HOLOSTARS is the least popular branch, only accounting for ~3% of hours watched.

If COVER were to invest more into growing the branch (they will likely do this before they expand into new geographies), then it would not only drive revenue upside but operating leverage as the branch currently has a decremental impact on margins.

I estimate revenue parity would drive 500bps+ of EBIT margin expansion as the incremental marginal profit would flow directly to EBIT.

Given little communication by management on branch-specific initiatives, it is difficult to assess the timeframe or probability of this occurring.

Risks

FY26 EBIT Margin Guide

On the 3Q25 earnings call the CFO emphasized that the company should not try to improve short-term profitability at the expense of long-term growth.

Though this is a consistent comment from management, when paired with a 4Q EBIT margin guide down and higher fixed cost growth in 3Q it increases the probability that management guides to little/no FY26 margin expansion.

If the EBIT margin guide was flat, it would be (~500bps) below consensus; this would drive the stock down (22%) assuming the multiple does not derate, which is an attractive entry point.

Talent Graduations (Retirements)

Talent graduations are always negative for the company, and 2024 was COVER’s largest year of talent graduations in its brief history.

Management is acutely aware of the impact graduations have on fans; the CEO, in a New Years note, acknowledged fan concerns and highlighted the company’s focus on organizational improvements in FY26.

Proper talent management and retention should remain the highest priority at the company; revenue, IP value, and sometimes dedicated fans leave with the talent.

Additionally, investors should be aware that longer-tenured talents graduating (especially Shirakami Fubuki18) will likely result in greater fan backlash that could have an outsized financial impact.

Engaged Fan Wallet Pressure

The majority of COVER’s non-licensing revenue is generated by a small percentage of its total fanbase.

These highly engaged fans have multiple oshis and spend upwards of ¥100,000 annually with COVER.

I think it is unlikely that these fans will stop spending altogether because of budget pressure, but I think it is worth emphasizing the concentration of revenue.

COVER needs to continue to grow its fanbase and expand its merchandise offerings more attractive to lightly engaged fans in order to durably grow revenue.

Branch Closures (HOLOSTARS)

Though it is clear that HOLOSTARS does not perform as well as hololive from an hours watched perspective, it would be the fifth largest VTuber company in market share (1%) if it was treated as its own entity.

I think COVER should invest more resources into HOLOSTARS to grow the viewer base and compete with Nijisanji, which is ceding market share.

If COVER shuts down HOLOSTARS I think it would be a net negative, despite cleaning up near-term financials, due to the heavy fan backlash.

Part of COVER’s brand strength is being known as one of (if not the most) talent-friendly VTuber companies in the industry; shutting down the branch would negatively impact the goodwill the company has built with fans.

Contact

If you have any questions, want to discuss COVER further, or send hate mail, please leave a comment, send me a message, or email me at research@nocturnal-research.com.

Appendix

Examples of Content

Music / Concerts: Hoshimachi Suisei Live at Ookini Arena Maishima

Licensing: Omocat x hololive EN merchandise

Collaborations: One Piece theme song collaboration with hololive

Other: Shishiro Botan breaks Guinness World Record, Converse x Hoshimachi Suisei, Usada Pekora nominated for Content Creator of the Year

Important Data Sources

VStats - Provides monthly, quarterly, and annual data on VTuber hours watched by talent and agency.

PLAYBOARD - My primary source for talent-specific data (ACCV, PCCV, subscribers, Super Chats).

hololyzer - A free website that tracks data on individual streams for talents across several agencies (namely hololive production).

Yano Research Institute - Infrequent reporting on “Cool Japan” trends and otaku population analysis. You can purchase their larger annual reports but some of them are not available in English.

COVERedge - COVER’s new owned-media website that posts interviews with corporate heads on strategy and initiatives.

Abridged Income Statement

For the full model, please contact me at research@nocturnal-research.com.

COVER generally owns the IP for all of their VTubers with one possible exception, Hoshimachi Suisei, the only talent that brought her VTuber model with her when she joined the company.

The income a talent generates with COVER, net of COVER’s take, is generally greater than what talents would make as an independent VTuber due to the scale of the audience and additional revenue streams. Additionally, note that talents reinvest their remuneration back into their own project, which explains why ‘performer remuneration’ is a lower percentage of revenue than the actual rate COVER pays the talents.

Of the four main components of this revenue line (memberships, Super Chats, advertising, and music royalties), Super Chats and music royalties are usually recorded as net of platform take rates. This means that platform fees for memberships and advertising are recorded as a cost in ‘other cost of sales’.

Toei Animation and Sanrio have 45%+ and 60%+ EBIT margins, respectively, on their licensing revenue.

Oshikatsu means the voluntary act of supporting someone or something that you particularly like or enjoy. Participants refer to the target of their support as their ‘oshi’. An example of this would be ‘Swifties’ supporting Taylor Swift, their oshi.

The company’s VTuber management and production business is hololive production, which has two main branches (hololive for female VTubers and HOLOSTARS for male VTubers) that are then subdivided by the language of the target audience.

If the aggregated subscriber count were treated as a single channel on YouTube, it would be the 16th largest channel on the platform.

Management did not provide a description for this metric, but I interpret it as averaged monthly unique viewers, a metric that can be found on a YouTube channel’s video analytics dashboard. The 21M number was inferred from a chart in their FY24 presentation.

A good sanity check for the overall influence of VTubers relative to other forms of entertainment in the US is to check the artists alley at anime conventions. Anecdotally, VTubers were the third most popular art / item category behind anime and gacha games at Anime Expo in 2024. Of the VTuber goods, the majority were related to hololive, Nijisanji, and larger independent VTubers.

Anycolor typically folds the failed branch into their main branch while retaining some of the talents.

Anycolor’s talent count in this analysis is their reported talent count, which excludes their South Korea, Indonesia, and China-JV talents. If these were included their total talent count would be 233.

Otaku is a term in Japan used to describe people with an obsession that typically relates to anime, manga, etc. These individuals are some of the most likely to be fans of VTubers.

ACCV measures the average number of viewers over the course of a livestream. When used across a branch with multiple talents (such as hololive production) it is the average viewership across all talents across the branch. This is a greater indicator of fanbase growth than subscribers because it demonstrates active engagement.

This merchandise relates to a talent’s anniversary, birthday, or other milestones. Typically, the talent plans what merchandise will be sold, so fans that are heavily engaged typically buy it to support their oshi. These merchandise items tend to have a higher ASP than in-house goods.

This is under the assumption that COVER is successful in growing ACCV at a 10% CAGR, which would likely push the majority of talents to the 1M+ subscriber level (excluding HOLOSTARS).

The company did not specify whether this was an annual or a single-quarter target (exiting FY28 with a 30% EBIT margin). I am assuming the company meant this as an annual target.

Note that COVER and Anycolor are yet to complete their fiscal years, which end in March and April, respectively. FY1 estimates refer to their current uncompleted fiscal years.

Fubuki is credited by fans and other talents with working behind the scenes to help COVER become the company it is today. She has on several occasions noted that as long as she is with the company it is in good hands and the talents are being treated well. In the case of her graduating with no positive message to fans, there will likely be significant backlash, especially from highly engaged fans.

This is a great analysis! As the company expands more into North America, do you see any potential for them to move towards low or no marginal cost products that Americans seem to like? (E.g. digital products, skins, callouts on streams that you see on Twitch)